It's All About Cash Flow

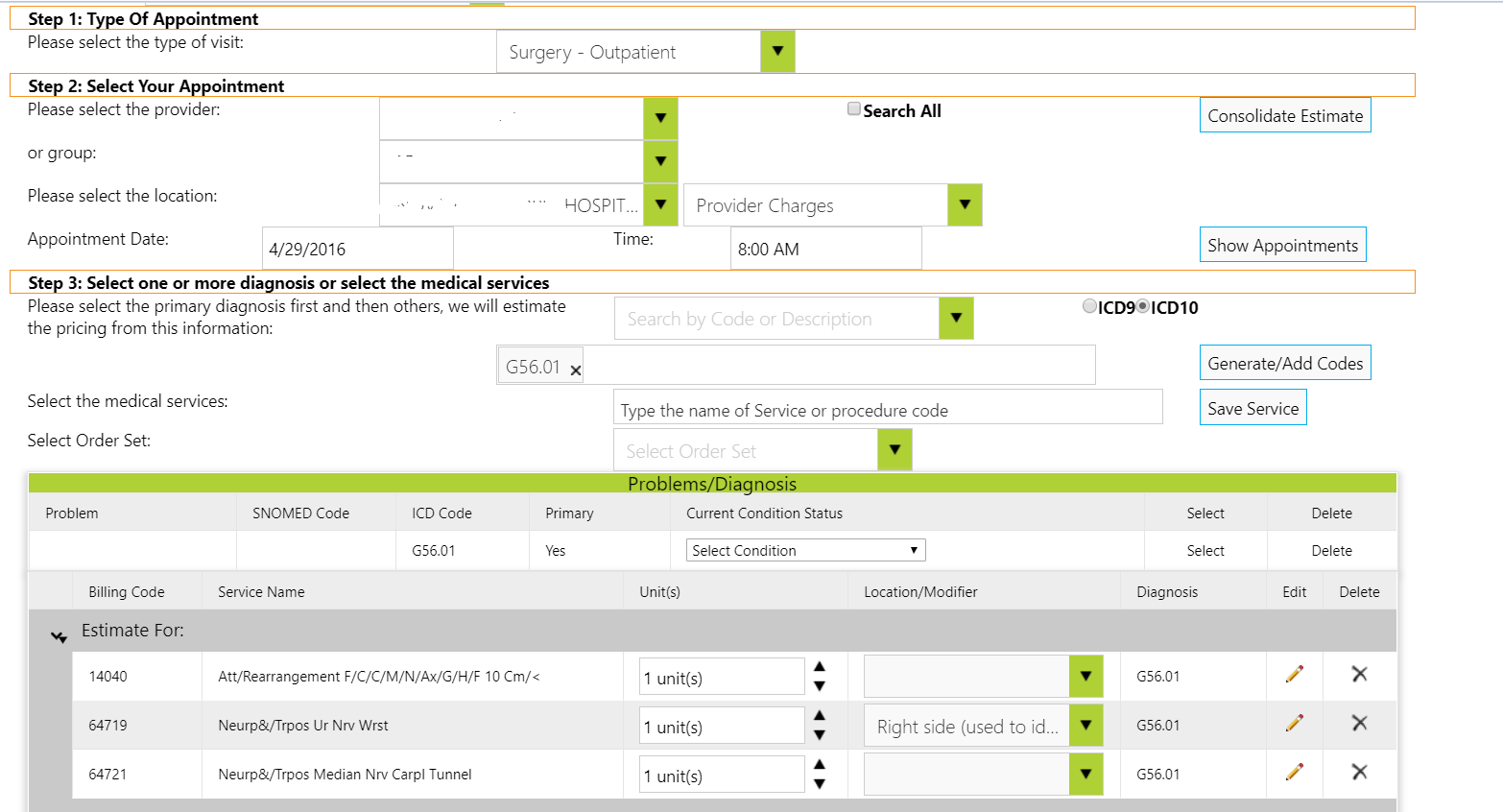

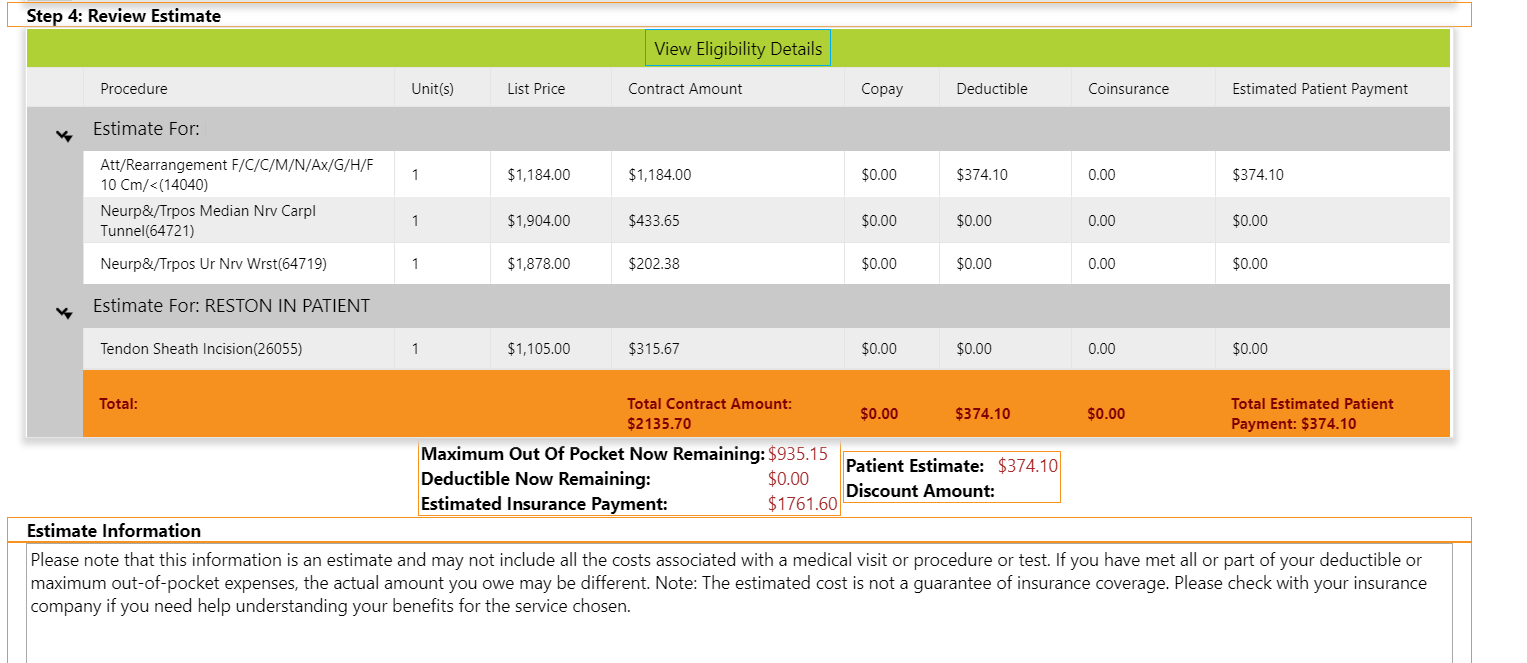

Cash Flow is the life-blood of any organization. It focuses on assuring that all organizations (for profit or non-profit) have a continuing stream of cash to pay their bills and keep providing care to patients. Enablemypractice™ provides an advanced HIPAA compliant, cloud-based, clinical and billing solutions platform to enable healthcare organizations generate consistent and predictable positive cash flows. With high deductible plans and coinsurance, patients are responsible for paying a significant portion of medical bills. No one likes surprise medical bills. To prevent none payment or significant delays in payment, up front estimates determine the amount patients owe and allow them to pay in advance of the procedure or service. This prevents angry patients and improves the timing of payments. Moving the Process Up-Front! Our Upfront estimator recommends the proper billing codes, checks the patient insurance, checks what insurance has paid for this procedure, calculates an estimate, generates an estimate statement, and allows the patient to pay online or in the office. This process also prevents insurance payment issues. Hospitals or surgical centers generate estimates for everyone involved in the surgery, even when they are working for different legal entities. The patient gets one consolidated estimate and each organization collects payments independently. Physicians and hospitals are able to offer payment plans and collect estimated payments before or at the time of service, which keeps administrative costs low and allows patients to spend less time in the office. Patients are sent text and/or email notifications. “UP-FRONT” enhances patient satisfaction, avoids unexpected surprises and improves cash flows.

LEARN MORE